Fler böcker inom

- Format

- Häftad (Trade Paper)

- Språk

- Engelska

- Antal sidor

- 400

- Utgivningsdatum

- 2000-06-01

- Förlag

- Plume Books

- Dimensioner

- 229 x 153 x 24 mm

- Vikt

- Antal komponenter

- 1

- ISBN

- 9780452281806

- 400 g

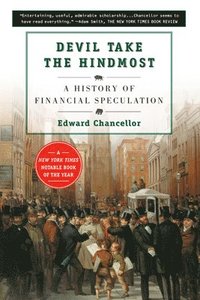

Devil Take the Hindmost: A History of Financial Speculation

253

- Skickas från oss inom 3-6 vardagar.

- Fri frakt över 249 kr för privatkunder i Sverige.

Passar bra ihop

De som köpt den här boken har ofta också köpt Slow Productivity av Cal Newport (häftad).

Köp båda 2 för 452 krKundrecensioner

Har du läst boken?

Sätt ditt betyg »

Fler böcker av Edward Chancellor

-

Capital Returns

Edward Chancellor

We live in an age of serial asset bubbles and spectacular busts. Economists, policymakers, central bankers and most people in the financial world have been blindsided by these busts, while investors have lost trillions. Economists argue that bubbl...

-

The Price of Time

Edward Chancellor

A comprehensive and profoundly relevant history of interest from one of the world's leading financial writers, The Price of Time explains our current global financial position and how we got here The tradition of charging interest on l...

Du kanske gillar

-

The Culture Map

Erin Meyer

Häftad